125. Wealth Management | 財富管理

– Musings of Dr. Jamie C. Hsu, 10.23.2021

There have been a lot of unusual events and changes in the last few years: nationalism and pluralism are thriving, trade wars and treaties are coming and going, political leaders are ignoring the pursuit of democracy and becoming tyrants, and the massive global pandemic is disrupting businesses, jobs, and daily living in an unprecedented manner.

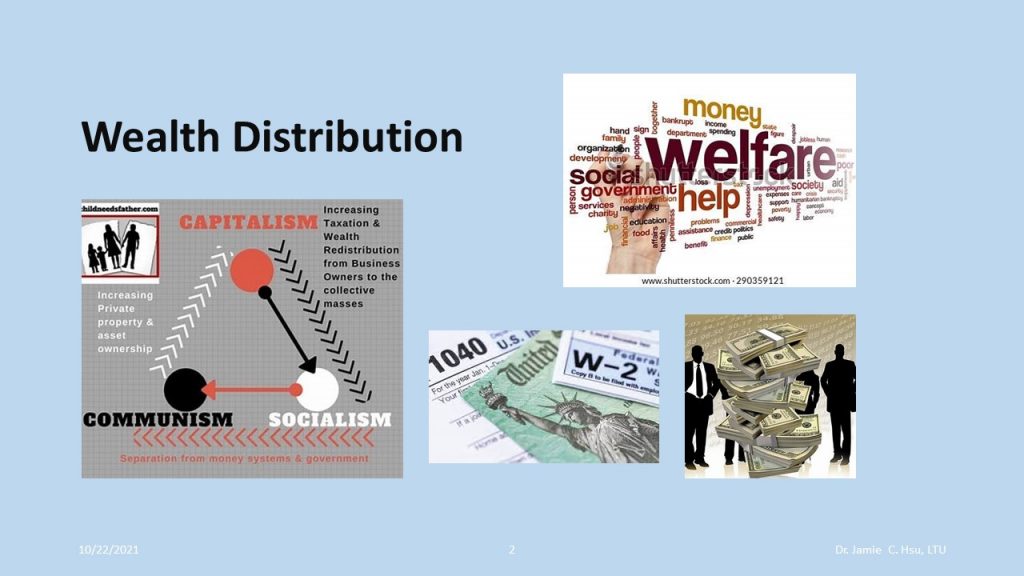

These events have disrupted global and national economies and also widened the wealth gaps among countries and people. To remedy such heightened inequality, different countries are trying different policies and emergency measures. There are special loan and welfare programs, emergency financial aid, common prosperity initiatives, rent and food subsidies, and many other policies to create jobs, interject money flow, and beef up infrastructure. Curiously enough, there seems to be a mixture of capitalist, socialist, and communist policies and tools being used by all. They may rely on market capitalism to generate wealth and use socialist programs or tax schemes to distribute such wealth and minimize wealth concentration and gaps. Or, more drastically, the communist approach would be to take over and nationalize the industry and business.

Although politicians, economists, and financial leaders have proposed and used various tools to manage the nation’s and citizen’s wealth, the fundamental approaches are relatively simple. There are three components of managing wealth:

Create the wealth: by growing it through agriculture, mining raw materials from underground, and making products with know-how and manufacturing facilities. These are the basic sources that can create real wealth for us.

Distribute the wealth: with taxes, using various business laws, antitrust and monopoly controls, and providing incentives to foster new industries and businesses. Many service-based businesses such as healthcare, financial and legal services, insurance, and merchants will be created to service the three primary wealth-creating industries. Thus, the wealth is distributed to the service industry and many others.

Utilize the wealth: by expanding social welfare, medical programs, special subsidies, infrastructure, charities, and various non-profit community organizations. The wealth is further distributed and utilized by more.

This is my simple, non-expert’s understanding of Wealth Management. I hope it will trigger some interesting discussions among friends.

財富管理 (2021/10/23)

-作者 許俊宸博士

-中譯 薛乃綺

過去這幾年發生許多不尋常的事情跟變化:包括民族主義以及多元文化主義的興起、貿易戰的威脅來來去去、政治領導者無視民主訴求反而變得專制、大規模的疫情正以前所未有的方式擾亂企業、工作、以及日常生活的運作。

這些事件不但打亂全球各國經濟,也擴大了國與國之間、人與人之間的貧富差距。為了彌補如此不平等的加劇產生,各國正嘗試採取不同的政策及緊急措施。包括了特別貸款及社福計畫、緊急財政措施、均富倡議、租金及食物的補助、以及其他許多創造就業、增加資金流動和加強基礎建設的政策。說來也奇怪,整體來看大家採用的方式就像是資本主義、社會主義和共產主義工具的混合體。他們也許依靠市場資本主義來創造財富,並使用社會主義計畫或稅收方案來分配這些財富、最大限度地減少財富集中以及差距;或者更徹底來看,共產主義的作法就直接接管或將企業國營化。

儘管政客、經濟學者以及財務管理者已經提出、並開始使用各種工具來管理國家和公民的財富。回到基本來看其实相對簡單,可以把財務管理分成三個部分:

創造財富:透過農業、挖礦等天然資源,透過專業知識及製造設備來生產產品。這是可以為我們帶來真正財富的基本來源。

分配財富:透過稅收、使用各種商業法、反壟斷和壟斷機制的控制,並提供激勵來培育新的產業與企業。包括有許多以服務為本的業務,像是醫療保健、金融服務、保險等;都为了服務这三大創富產業而成立许多商業。因此把財富分配到更多人的手中。

利用財富:透過擴大社會服務、醫療項目、特別子公司、基礎建設、慈善機構以及各種非營利社區組織等。这些財富就被更多人直接或间接的用到。

以上是我對財富管理淺易、非專家的理解。希望能跟我的好朋友們之間有更進一步、更有意思的討論。